ACTIVIST VC BLOG

Avoid expensive mistakes: foreign options and US tax

June 1, 2018In general, we love options and think they are a useful and necessary tool for startups:

- Options are great for aligning the interests of a company’s key people and the VC: options reward increasing company value and realizing it in an exit

- However, it is a good idea to keep the company cap table pretty simple. Experience shows that options work best as an incentive for a small group of key personnel. The rest of the employees are often better taken care of with bonuses.

However, options often present you with significant legal and tax issues that need to be carefully considered and addressed.

The Wild Wild West

If you plan to go to the US, you need to keep in mind that stock options are heavily regulated there. You would be well advised to do your homework on stock option regulation before you grant options to someone who pays their taxes in the US. Otherwise, you may end up with options that become taxable to your US employees and consultants every time the option vests at tax rates up to 85% (in California).

Being a foreign entity or citizen (we use Finland as an example here) does not make you immune to this:

- These laws apply even if the stock options come from the Finnish parent company’s stock option plan.

- They can also apply to your employees who received an option while in your employ in Finland, but who later transfer to your US operations and become US tax subjects.

The Infamous 409A

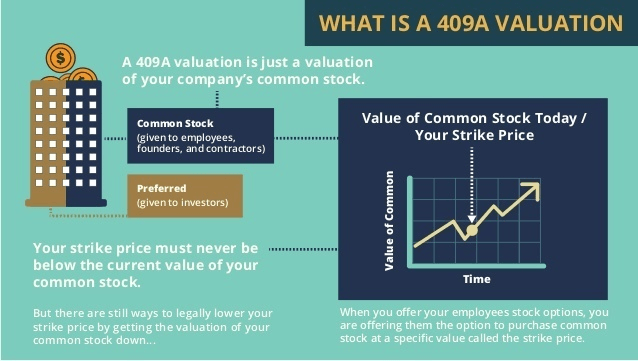

For venture backed companies, compliance with US tax laws requires modifications to the Finnish stock option plan and a so called “409A valuation” to set the exercise price of the options at fair market value at the time of each grant.

A 409A valuation is not the same as company valuation in an exit situation: it is determining what is an acceptable “fair market” value for a share of common stock underlying the options in light of the financial condition of the company and often done on a minority basis if the company has outstanding stock that has preferential rights over common stock (such as liquidation preferences or antidilution rights).

The Basics of 409A Valuation (Source: Redwood Valuation Partners)

The 409A process is very important for the option holders: options granted at an exercise price below the fair market value (on grant date) are taxable every time the option vests at income tax rates which are made draconian by an added 20% federal penalty tax and similar state penalty taxes. Tax withholdings and other charges are ultimately the responsibility of the company.

Options and Due Diligence

If your company is contemplating a US exit or a US venture capital investment, option compliance has become a part of standard due diligence – nobody wants to inherit a major tax issue.

By the way, US companies struggle with these same option issues. There are US companies that have had to spend tens of thousands of dollars to fix a noncompliant option program in connection with due diligence. If the noncompliant program cannot be fixed after the fact, the company (or its US sub) is left with an ongoing tax liability.

Finally, all US state laws require that options granted to person in that state comply with the state’s securities laws. The same goes for US federal law. Sometimes you may need to file your option plan with the state (such as in California).

To sum up, failure to comply with tax laws may result in disastrous personal tax consequences to the very same US employees and consultants you wanted to motivate, and become a tax burden on the company’s (or its US sub’s) exit and fund-raising plans. Your option plan needs to be made US compliant and thereafter be administered within the requirements of the US tax and securities laws.

What Price Compliance?

There are numerous providers for 409A (and related) services. The price range is equally large: it can vary from around $100 per month (provided as a continuous service which is becoming more and more common) to up to $5,000-$10,000 or even more per valuation, depending on the size and complexity of your cap table and option program.

If you need to get a 409A valuation for your company, drop us a line and we can recommend a few services that you can then compare and benchmark.

This blog entry has been written in cooperation with and using the ample experience of Sari Laitinen – a good friend of ours and a trusted advisor to many Finnish businesses and management in their US legal questions. Thanks once again, Sari!

PS. You can look up option program terminology and other interesting startup and investment jargon in our Activist VC Glossary.

WE'D LOVE TO HEAR YOUR COMMENTS